Gov. Mike DeWine introduced the 2026-2027 executive budget in a press conference on Feb. 3, detailing several policy agendas his administration has laid out.

Key highlights in the budget include investments into a refundable child tax credit, childcare, water quality and first-responder services.

In addition to these highlights, the budget also includes funding for affordable housing through the Ohio Housing Investment Opportunity program, with the budget recommending an additional $100 million in funding for the 2026 fiscal year.

The governor’s proposal to invest $100 million into the Ohio Housing Investment Opportunity Program was welcomed by affordable housing advocacy organizations.

“The Governor’s new $100 million Housing Investment Opportunity Program has the potential to bridge critical gaps, particularly in rural communities that need more affordable housing options,” said the Home Matters to Ohio Coalition in a statement.

The Coalition on Homelessness and Housing in Ohio (COHHIO) also praised the proposed investment.

“We are pleased to see Gov. DeWine continuing the discussion on fixing Ohio’s affordable housing shortage in his new budget proposal,” said Amy Riegel, executive director at COHHIO, in a statement released on Feb. 4. “Gov. DeWine’s new proposal to invest $100 million in rural housing opportunities has the potential to create more affordable housing in high-need areas where development is especially challenging.”

Affordable housing has long been a key part of the governor’s agenda, with DeWine signing House Bill 33 in 2023 to fund the Welcome Home Ohio program which would fund the incorporation of 2,150 single-family homes throughout the state.

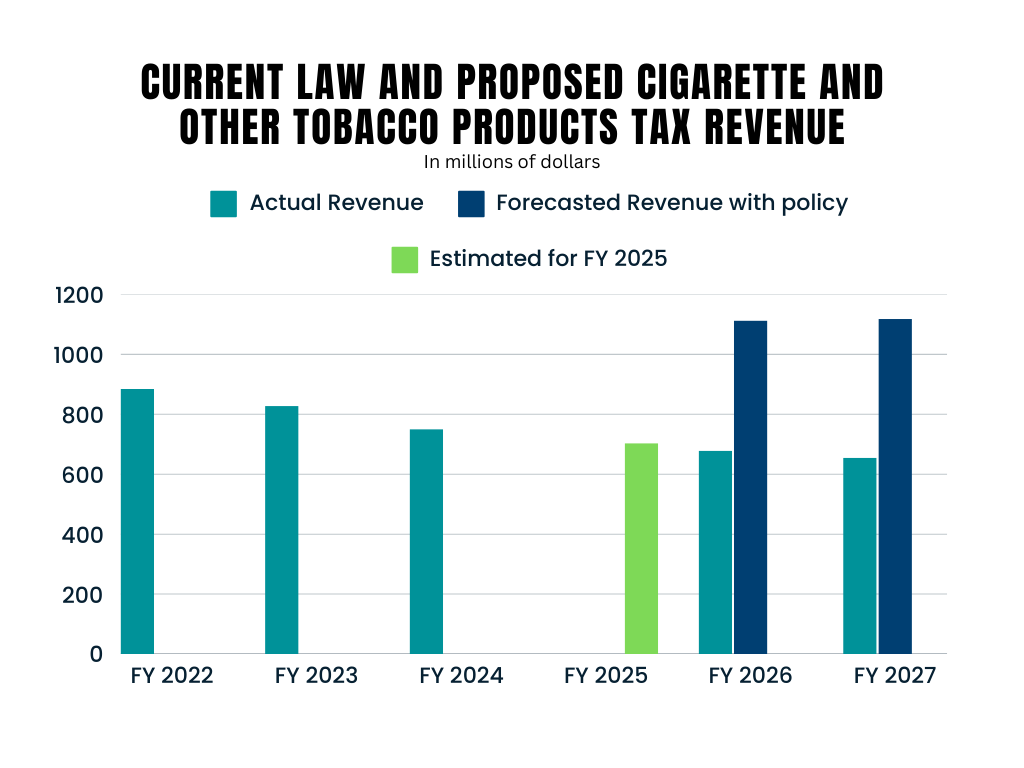

The budget proposes increases of consumption taxes for tobacco products to help fund these programs, with the writers noting that revenues from these products have steadily decreased since the start of the COVID pandemic.

According to the executive budget, tax revenues from tobacco sales have gone from $884.6 million in fiscal year 2022 to $750.4 million in fiscal year 2024. The budget report attributes this downward trend to a “long-term decline in cigarette use that has driven the tax base downward over several decades,” with other tobacco products only partially offsetting that decline.

The executive budget also notes the Ohio Office of Budget and Management (OBM) forecasts a continuing downward trend in tobacco tax revenues for fiscal years 2026 and 2027 if current policies apply.

To combat these declining revenue streams, the executive budget proposes an across-the-board increase in tax rates for tobacco products. Tax rates for cigarette packs would increase to $3.10 per pack from the current $1.60 rate. Non-cigarette tobacco products would be taxed at 42% of their wholesale price, up from the 17% tax rate that is currently imposed.

Revenue estimates for fiscal year 2026 would see an increase of 58.2% from the previous year for tobacco products if the proposed policy is implemented, with the executive budget forecasting revenue amounts of $1,112.7 million that fiscal year.

Ohio’s fiscal year 2026 starts on July 1.