University Vice President for Business and Finance Bill Mea spoke about the financial health of the institution in an interview, discussing the university revenue and enrollment, endowment spending and investments.

“I think, as an institution,” Mea said, “we need to do work to get ourselves… [to] a fully sustainable future.”

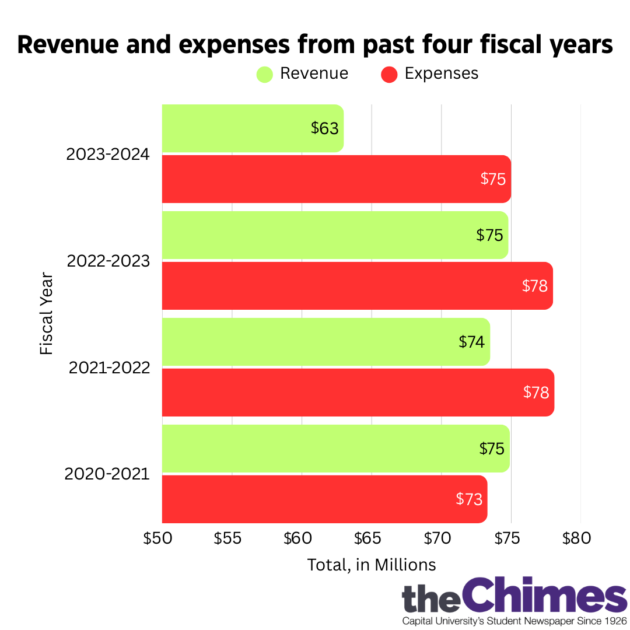

In the university audit of the 2023-2024 fiscal year by Maloney and Novotny, there was a reported $11.9 million deficit in revenue and expenses, as well as a reported $63.1 million in revenue and $75 million in expenses.

66% of the revenue came from student tuition and fees; however, the revenue from students could be significantly higher. The reported revenue from student tuition and fees was $90.6 million. Of that reported revenue, $48.9 million, a total of 54%, was ceded through unfunded scholarships. A large portion of this is through the Main Street Scholarship.

The university has ceded at least 50% of potential revenue in student tuition and fees through unfunded scholarships every year the past 10 years in an effort to make attending the university more affordable for students.

“It is our work to try to produce a net price that a student can actually pay and to be able to attend and sustain themselves,” Mea said.

Instead of offering less scholarships, the university is pursuing other methods to increase revenue and decrease expenses.

The primary method of increasing revenue is by increasing enrollment, as the number of undergraduate students enrolled at the university has decreased significantly since 2020. According to the university’s most recent fact book, there were 2282 undergraduates enrolled, a figure which has shrunk to 1609 undergraduates enrolled in 2024.

Revenue from student tuition and fees has decreased alongside enrollment from $104.5 million before unfunded scholarships in 2020, to $90.6 million before unfunded scholarships in 2024.

Last week, 225 incoming first-year students placed their deposits to the university, which is a stark contrast to the last two years, with only 148 and 155 deposits respectively. This metric is a positive marker and signifies a large potential increase in enrollment and revenue.

The university also offered an early retirement incentive to 86 faculty and staff, which will save the university an estimated $2.8 million annually.

The university’s endowment is another significant metric of financial health.

According to A.R. Cabral for US News, a university’s endowment fund is “a collection of financial assets that the school can periodically pull from to cover an array of costs while intentionally growing the fund over time.” Andrew Gillen, a senior policy analyst at the nonprofit Texas Public Policy Foundation, told Cabral it was “a super-charged rainy-day fund.”

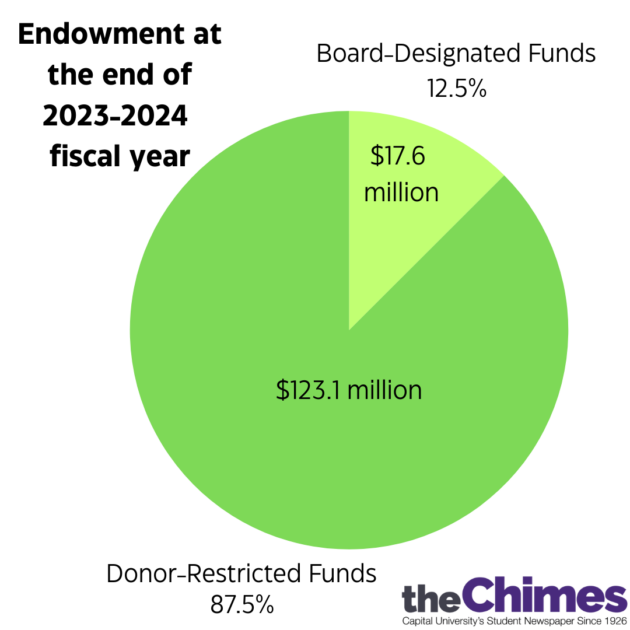

In the latest audit, the university’s endowment was reported to be $140.7 million, an increase of $9.6 million from the previous year.

The university currently has an endowment spending rate policy of 4.5%, a figure which Mea claimed to be comparable to other institutions. The rate is determined by calculating 4.5% of the average of the previous 12 financial quarters.

Mea said approximately 50% of the money spent from the endowment is in scholarships, while the rest of the money spent is on an assortment of expenditures, like library and equipment purchases.

The endowment is divided into board-designated funds and donor-restricted funds. The board-designated funds can be spent at the discretion of the Board of Trustees. The donor-restricted funds are only used for the designated purposes for which the donor gave the money.

Of the $140.7 million in the endowment, $17.6 million is board-designated and $123.1 million is donor restricted.

To make the endowment more flexible, the university is approaching donors to remove restrictions from funding.

Mea said they are trying to remove restrictions from the funding “as much as [they] can.”

“The revenue from that (unrestricted funds) is fully unrestricted, so the 4.5% we take out each year, that money can be spent for any purpose,” Mea said.

Mea also gave a “practical” figure of $10 million of restricted funds the university is aiming to remove restrictions from.

The process of removing restrictions can be a complicated legal process. Because of this, Mea said the university was working with a law firm that specializes in either fully releasing or easing restrictions.

The university is targeting funds that are highly specific in their purpose. Mea said one restriction may refer to a specific school and major, such as a trombone student from Dublin High School.

Mea said criteria of that type are “very narrow and often hard to fulfill.”

“There’s a level of specificity on some of the endowments that makes it actually rather difficult to give away some of the scholarship loans,” Mea said.

Mea said the university is asking the donors, or their family if the donor is deceased, to ease or remove the funding restrictions.

To prevent further complications in restrictions, the university now adds language in gift agreements to make donations more flexible if specific criteria cannot be met.

Unrestricted funds can also add to the university’s financial reserve, a total Mea reported to be $20 million, which also contains board-designated funds.

An area where the university recently showed vast improvement was their investments. Net cash flow from investments grew $20.1 million from the previous year.

Mea said an outside firm monitors their investments, and the growth last year was due to “mostly the market.”

However, that growth may be counteracted this year as Mea said current market “volatility” may negatively affect their investments; however, the university has certain defensive investments in place to prevent large losses.

The university received $9.9 million less in government grants and contracts last year, which Mea said was due to an Employee Retention Credit the university received the year prior. The one-time credit, worth approximately $10 million, allowed for employee retention throughout the pandemic.

Mea does not believe the university is in danger of losing more government funding due to recent Diversity, Equity and Inclusion laws, but said “it is certainly on our radar to make sure we are in compliance with any laws that we need to be in compliance with.”