It’s always exciting to see how new technologies revolutionize or change how we do things in our everyday lives. As I was scrolling through my email one day, a headline caught my eye. It was about Finn, a new service from my bank, Chase. It really is more than a new service though, it seems like it’s a whole new way to bank: it’s crafted specifically for us millennials. “How does such a thing work?” I asked myself. Below, I will explain all about it and if Finn is worth your time and money.

What is it?

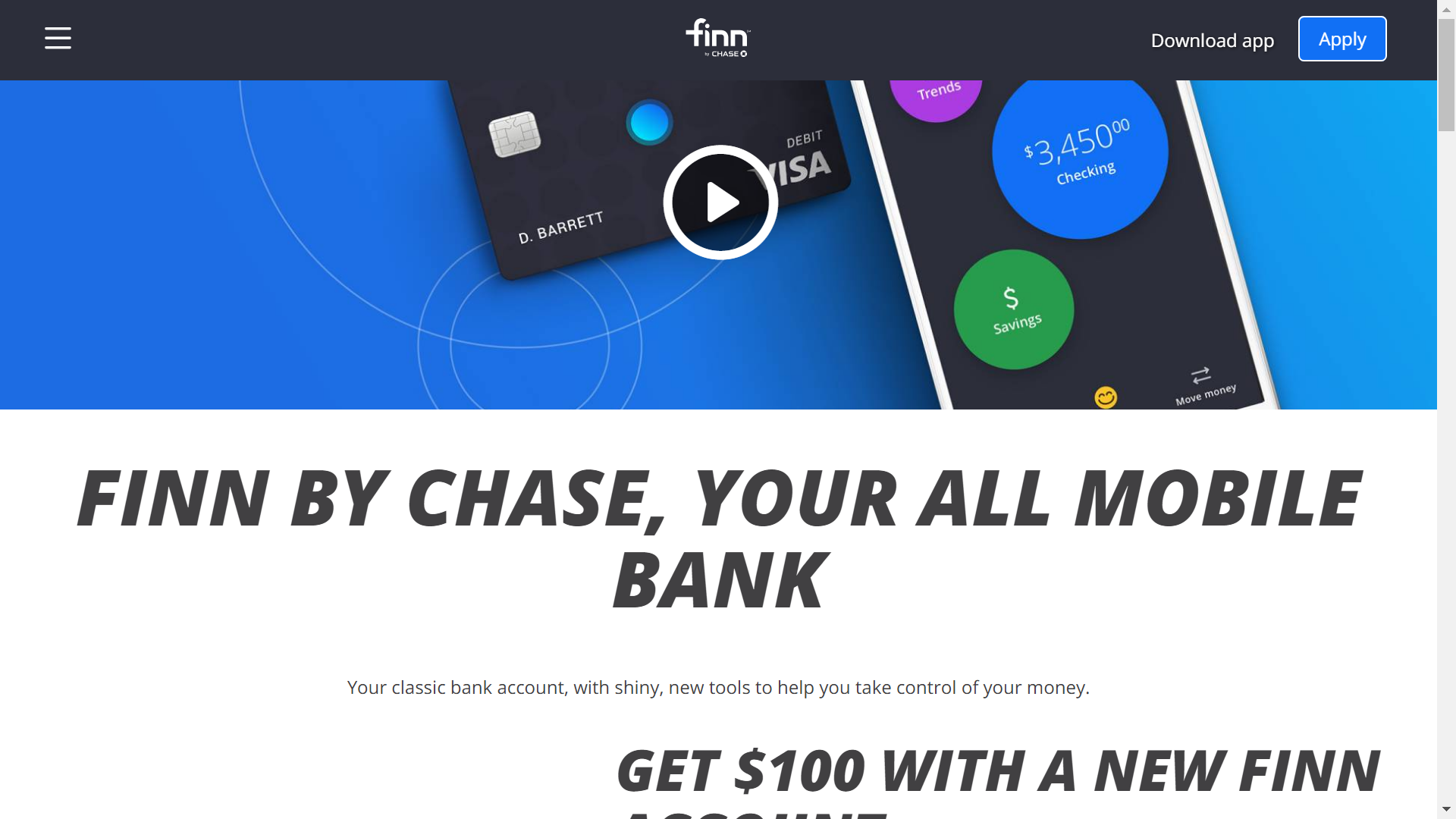

Finn by Chase is “Your All Mobile Bank.” Everything that you need is right in the Finn app. There is no need to go into a traditional bank, have a banker open an account for you, or any of that fuss. You just download the app, set up your account, and you are good to go. Finn does both checking and savings accounts, and will actually help you intertwine the two. Since Finn is a Chase product, you will have access to all of Chase bank’s ATMs to use with no additional charge. Other than that, everything else can be done through the app. Checks can be deposited by taking a picture of them, transfers to friends can be done, and any troubleshooting can apparently be resolved by a quick call or text to Chase customer support, which can be found in the help section of the Finn app. A Finn account also comes with a shiny new Finn by Chase debit card for you to use whenever you are out and about.

What’s the Advantage?

I obsess over properly tracking my spending and budgeting. Maybe a little too much, to be honest. I use Intuit’s Mint as my personal budgeting service of choice (it’s a great, free tool by the way). Maybe you don’t want to have to hand over your bank account information to a third-party service, though. Or maybe you just don’t want to have to go through the hassle of closing one app and opening another to see your budgets. If that sounds like you, then worry no more: Finn has got you covered. While traditional banks offer a basic list of transactions on your account via a website or mobile app, Finn takes this idea a step further, with analysis of your spending habits. It has three main features that all work together to help you analyze your spending: rate purchases, track spending, and save automatically.

Rate My Purchases?

A new feature that I have never seen before in budgeting apps or bank apps is a rating system. Finn allows you to categorize your purchases into three ratings: Things I Want, Things I Need, and Things that make me Happy. What does Finn do with these ratings? I don’t know, to be honest. This feature could be more of a gimmick, but time will tell how useful customers find it.

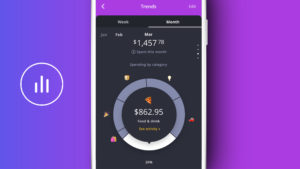

Finn Will Track Spending for You

You ever wonder how much you spent on coffee in a month? How about gas on your weekly commute or visit home? Or how much money you burned at your latest mall trip? Finn can help you with this as well. The app will break down your spending into different categories and present the data to you on an easy-to-read pie chart, complete with emojis to label each piece of the pie. It might be a little corny, but it’s useful nonetheless.

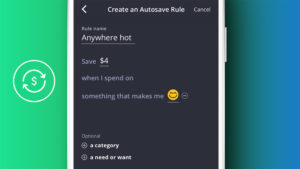

Automatic Saving

Finn allows you to automatically save. How? Well, it’s simple. You can set the app to take out a little extra money each time you, say, visit your favorite restaurant, or spend money on clothes, or every transaction you make the day after you get your paycheck, and will automatically put that money into a savings account. Sure, everything may seem a little more expensive to you, but you will be thanking yourself later.

You Can Get It Today

Finn is available to download on the iPhone today. Android support is still in the works. For anyone who is interested in switching banks, needs a bank, or just wants to try a new system of managing your money, maybe give it a try. Currently, Finn is running a promotion where you can get $100 when you open a new account. I will not be adopting it, but I am excited to see Chase take a risk here with an innovative, 21st century approach to banking.