Most students attending college have it, yet few of us like to talk or even think about it: student loan debt.

But how does Capital University compare to other colleges in terms of cost, financial aid, and student loan debt? Do we have it better than most? Worse? Or somewhere in-between?

According to lendedu.com, Capital ranked number 25 in the state of Ohio and number 603 in the nation as of last year (2018) in terms of the average amount of student loan debt its students have.

For a sense of comparison, Wright State University’s Lake Campus beat us out for the number one spot in the state, ranking 76 in the United States overall.

This means, at roughly $20,808 of debt per student, their students had the lowest debt per borrower out of any other school in Ohio and the 76th lowest debt across the nation.

So what does ranking at number 25 in Ohio mean for Capital students?

Roughly 77 percent of Capital graduates leave the university with some amount of student debt, which is actually down 3.90 percent from 2017. The average debt per Capital student, however, has increased 2.93 percent since 2017, and now sits at roughly $33,496 per student borrower.

In addition to federal student loans, 17 percent of Capital students ended up having to take out private loans in 2018 to help cover the remainder of their school costs, but this is down 29.41 percent from 2017, meaning fewer students have needed to supplement their schooling costs with private loans.

Student loans, however, aren’t the only part of the equation; there are various other factors that affect cost, including a variety of scholarship and grant options.

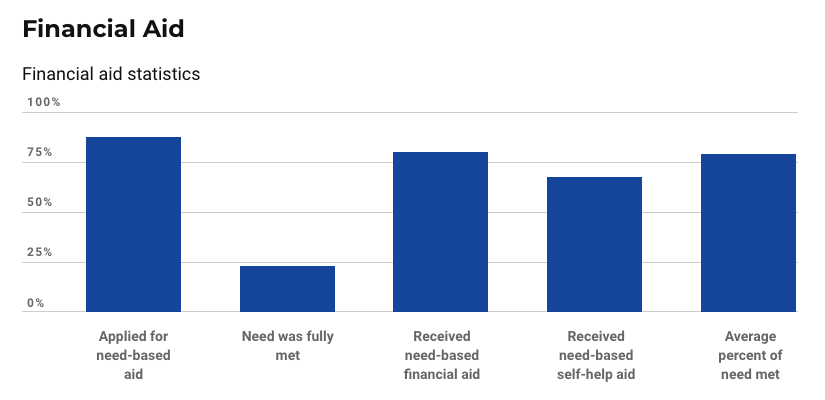

According to usnews.com, which ranked Capital at number 28 in Regional Universities Midwest, 80 percent of full-time undergraduate students at Capital receive some kind of need-based financial aid, and the average need-based scholarship or grant award is around $24,558.

First-year student Annie Macom, a music education major, saw the benefit of reduced education costs firsthand when she applied to Capital.

“[Capital] gave me the most money out of any school I applied for,” Macom said.

Chase McCombs, a first-year film major, also experienced the benefits of lowered costs — in his case, no cost at all. He received a tuition exchange scholarship, allowing him to take classes virtually for free.

“I don’t have, like, any debt at all,” McCombs said. “My dad works for another college, so they’re going to send me to this college for free. That way somebody who works here, their kid can go to his college for free.”

It seems that despite Capital’s statistics and rankings in the mid-twenties — which aren’t awful, even though they suggest that there is room for improvement — there may still be hope for less expensive schooling in the future.

“Our board is very cognizant of the costs that we pass along to the students, so there’s a lot that we do to try and keep those costs low,” Susan Kannenwischer, assistant vice president for enrollment services, said.

“We certainly look at, you know, ‘Are we out of line with other schools like us?’ . . . We want to make sure we don’t outprice ourselves in the market.”

Sources: <https://lendedu.com/student-loan-debt-by-school-by-state-2019/#OH>, <https://www.usnews.com/best-colleges/capital-university-3023/paying>

Editor’s note: An earlier version of the story misspelled the last names of McComb and Macom. The story has been updated with correct information.