The latest university financial audit and IRS 990 tax filing, both for the 2022-2023 fiscal year, provide information on the financial health of the institution.

The university’s total assets at the end of June 2023 stood at $294.4 million, a $17.7 million difference from the $276.6 million in the previous fiscal year. The total liabilities from the 2021-2022 fiscal year grew from $38.3 to $52.8 million, resulting in the net assets valued to be $241.7 million.

This is a $3.3 million positive difference from the prior year. In the 2021-2022 fiscal year there was a negative difference of $18.4 million.

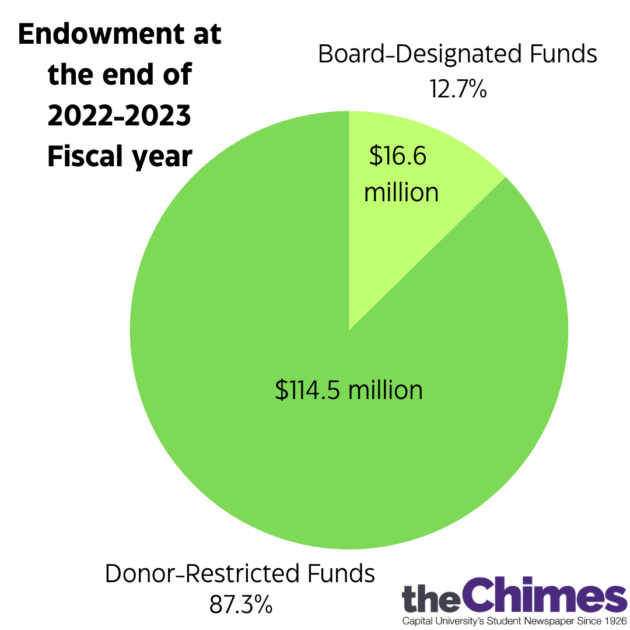

Certain funds are donated for a specific purpose and cannot be used for anything other than what the donor intended. $132 million of the net assets are donor restricted, while $109.7 million of the net assets are not.

In the audit by Maloney and Novotny LLC, there was a reported total revenue of $74.8 million and reported total expenses of $77.9 million, a loss of $3.1 million.

The university gained $94.6 million in student tuition and fees. However, the university provided students $50.6 million to students in unfunded scholarships. According to Awarded, a higher education fund management software, unfunded aid is used to “incentivize enrollment” by foregoing revenue.

After providing this much unfunded aid, the university only generated $43.9 million in revenue from student tuition and fees.

In the previous fiscal year, the university brought in $96.9 million in student tuition and fees and provided $51.4 million in unfunded scholarships. That year, the university generated $45.5 million in revenue from student tuition and fees.

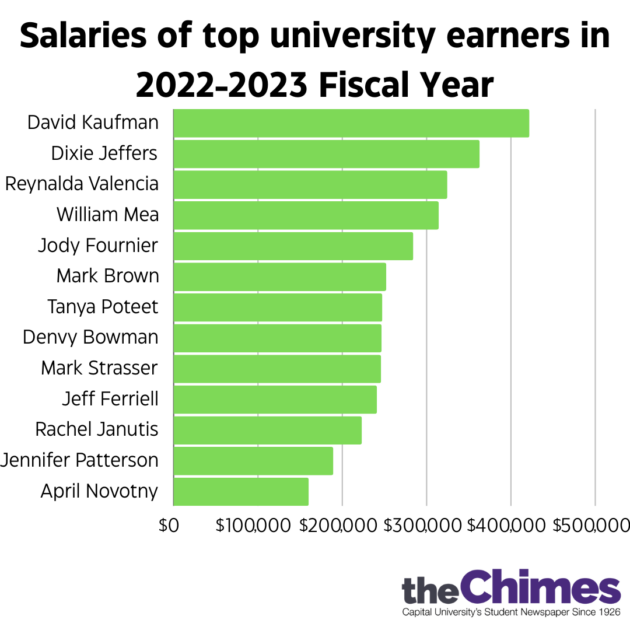

In the 2022-2023 fiscal year, the university spent $43.8 million on salaries and employee benefits, $1.2 million more than the previous year.

The top earners were university President David Kaufman, who was paid $421,907, then Interim Athletic Director Dixie Jeffers, who was paid $362,921 and Reynalda Valencia, dean of the Law School, who was paid $324,530.

William Mea, vice president of finance, was paid $314,381 and Provost Jody Fournier, was paid $284,168. The highest paid professors were Mark Brown and Denvy Bowman, who made $252,152 and $246,621 respectively.

The university paid for 29 independent contractors that received more than $100,000. Included in those contractors are Aladdin Food Management Services, which received $3.8 million, JP Morgan Chase Bank, which received $2.1 million, HES Intermediate Holdings (Janitorial services), which received $1.3 million and EAB Global Inc (Enrollment Strategy Consulting), which received $410,381.

The university purchased $264 million in investments and received $256.8 million in proceeds from the sale of investments. This represents a $10.5 million loss in the 2022-2023 fiscal year.

The university’s revenue and expenses were not all directly transactional. A key component that is listed as an expense is depreciation, which, according to Cornell Law School, is “the reduced value of something over time.”

All the university’s property, including the land, buildings and equipment, have decreased in value over time and are listed as an expense.

During the 2022-2023 school year, the land was valued at $14.1 million, $1.7 million less than the previous year. The buildings were valued at $119.2 million, $4.8 million less than the previous year. The library books were valued at $11.2 million, $4.6 less than the previous year.

The endowment grew in the 2022-2023 fiscal year, growing from $125.4 million to $131.1 million.

Of $131.1 million in the endowment, $114.5 million was with donor restrictions and $16.6 million was without.

The university did receive some government assistance, though notably not including the Higher Education Emergency Relief Fund (HEERF), which was $8.73 million that institutions across the country received during the COVID-19 pandemic.

In an interview last year, President Kaufman said, “We are not eligible for any more… that really did help lift us over the last two years.”

Included in government funding that year was the Pell Grant, of which the university received $3.2 million. The government also supplied $426,678 for work study.

In the independent audit, Maloney and Novotny LLC failed to identify any material weakness or significant deficiencies in the university’s financial situation.

The filing for the 2023-2024 fiscal year will not be available until May.