President-elect Donald Trump has made imposing additional tariffs on foreign imports a key part of his economic policy.

Tariffs are taxes levied on foreign-made goods, according to the Council on Foreign Relations. These taxes are typically a fixed percentage of a product’s value, which are then paid by the importer to the government.

These taxes often serve as an additional source of revenue for a country’s government. According to the Fordham Journal of Corporate and Financial Law, tariffs made up nearly 95% of the revenue for the U.S. federal government prior to the passage of the Sixteenth Amendment, which created a federal income tax.

Tariffs are often imposed to protect domestic industries from foreign competition, particularly in developing countries hoping to revitalize their burgeoning domestic economies.

Central to Trump’s tariff proposal is a plan to levy a 60% tariff on goods from China. The president-elect has also proposed that a 10-20% universal tariff be imposed on all foreign imports.

Trump has insisted that the countries exporting their goods pay for the tariffs, though these tariffs are generally paid by domestic firms to the federal government.

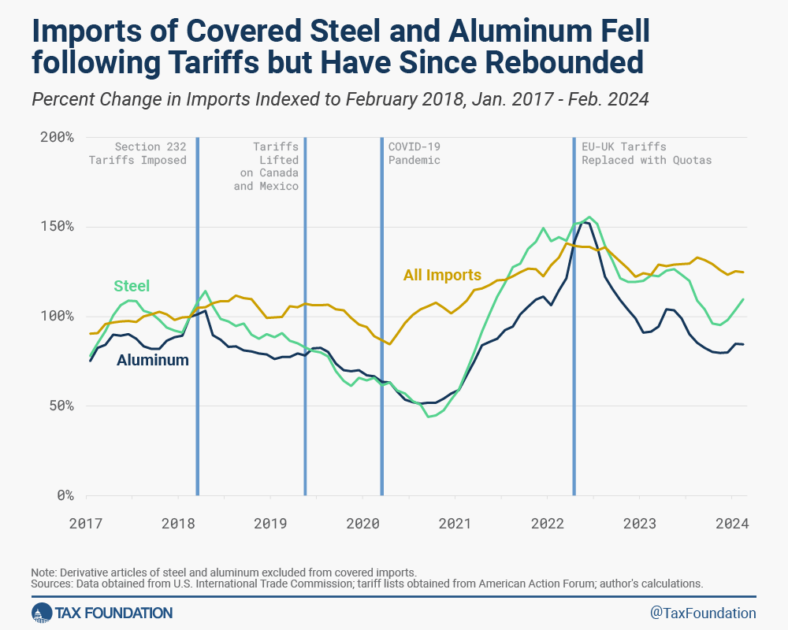

Reviewing the effects of tariffs, the Tax Foundation found that “tariffs raise prices for American consumers.” They cite a study that found that the costs of the Trump administration’s tariffs on washing machines, solar panels, aluminum and steel products from the European Union and China were almost entirely passed on to American companies and consumers.

The Tax Foundation cited another study that found that washing machine prices increased by $86 per unit after the Trump administration’s tariffs were imposed. This price increase extended to dryers, which, despite not being subject to tariffs, increased in price by $92 per unit.

However, the Tax Foundation also states tariffs are “likely a relative marginal issue” in the context of inflation. They note that recent increases in inflation are likely to have been the result of consumer shifts and supply chain issues during the pandemic, concluding that “tariffs are a minor piece of the puzzle related to overall retail prices.”

Still, Trump’s proposed tariff hikes could likely lead to long-term consequences. The Tax Foundation suggests by raising the relative prices of imported and protected goods, tariffs leave consumers with less income left to spend, thereby reducing “the after-tax value of income by reducing how much consumption people can afford.” They argue that this would have compounding effects on people’s incentives to work, thereby reducing productivity across the board.

Others contend that tariffs “provide sorely needed breathing room while more serious strategies and policies are developed and put into place,” according to the Economic Policy Institute (EPI).

The EPI found that the Trump administration’s aluminum tariffs provided breathing room for domestic aluminum industries, enabling the creation of “at least 55 new and expansion projects have been announced in downstream aluminum industries that will employ 4,500 additional workers and generate $6 billion in new investments.”

However, the EPI emphasizes that “tariffs alone are no substitute for comprehensive new trade and manufacturing policies to rebalance trade and rebuild American manufacturing,” advocating tariffs be used as a temporary measure to enable the U.S. government to enact fiscal and trade policies allowing the country to face the competitive challenge posed by economic rivals such as China.