Jan. 30 marked the beginning of the 2025 tax season.

The IRS announced this year’s tax season will bring a host of new filing options and updated software designed to ease the tax filing process.

The agency stated that improvements include “expanded features on the IRS Individual Online Account, more access to dozens of tax forms through cell phones and tablets and expanded alerts for scams and schemes that threaten taxpayers.”

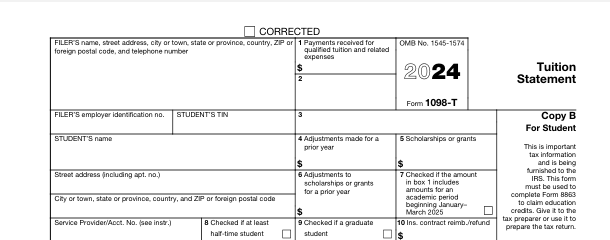

For most college students, tax season largely entails filing Form 1098-T, an IRS form that details a student’s educational expenses, which may qualify them for education-related tax credits.

“1098-T is a tax document that’s provided for students and families for money that they pay towards qualified tuition related expenses,” said Jeff Cisco, director of Student Accounts at the university. “Qualified tuition related expenses are tuition term fees, which is like your technology fee, your health and wellness fee, or your activity fee, and then course fees.”

Regarding miscellaneous expenses such as class textbooks, Cisco said these costs are not covered by Form 1098-T and have to be provided by the student on their tax filing forms.

According to the IRS, students can file for tax credits under the American opportunity tax credit (AOTC) for qualified education expenses, which include “books, supplies, and equipment the student needs for a course of study… even if it is not paid to the school.”

Students will need to add the amounts paid for these expenses to a separate Form 8863, which will then be attached to their Form 1040 tax return.

However, the IRS notes that the students are limited to a maximum annual credit of $2,500 for the AOTC, which does not cover certain expenses such as room and board, transportation or student fees.

Regarding student loans, Cisco said they count as a form of payment.

“But keep in mind, what we’re doing is based upon your charges during a tax year,” said Cisco, “and that’s where students get confused a lot of times. It’s based on activity in a tax year. So the tax year, obviously, is January 1 of a year through December 31.”

Cisco said that most universities bill for spring semesters in December, noting that the discrepancy between tax year and academic year is a point of confusion for many students.

“[T]he biggest thing is there’s just such a misunderstanding as to how it plays out,” said Cisco, referring to the tax filing forms and process.

Cisco recommends that students and parents do their own math regarding education expenses before taking the tax forms to a qualified tax preparer, noting that some tax preparation software fails to account for the nuances in a student’s situation.

“For instance, a graduating senior that graduates in May, they will have scholarships and grants on the 1098-T but nothing in box 1 [on the form] because we did all those charges in December,” said Cisco, explaining how some tax preparation software will fail to take this scenario into account. “So that’s why you got to do your math.”

The deadline for filing federal tax returns is April 15. For students filing an Ohio tax return, the deadline is also April 15.