Despite the Biden Administration’s previous clashes with the Supreme Court over student loan forgiveness in Biden v Nebraska, The Saving on a Valuable Education (SAVE) plan is set to begin distributions this year.

The SAVE plan is the Biden administration’s latest attempt to address increasingly rising costs of education in the United States.

Within the Department of Education resides the Federal Student Aid Administration (FSA), who have been charged with the distribution of roughly $475 billion dollars over the 10-year budget window.

The program currently targets funds for low and middle-income families. The SAVE plan will decrease monthly payments by increasing the income exemption from 150% to 225% of the poverty line.

Any single borrower whose annual income is less than $32,800, or a family of four with an adjusted gross income of less than $67,500 will qualify to save at least $1000 per year. Additionally, the plan eliminates all remaining interest for both subsidized and unsubsidized loans after a scheduled payment is made.

The plan currently provides eligibility for the following loans:

- Direct Subsidized Loans

- Direct Unsubsidized Loans

- Direct PLUS Loans made to graduate or professional students, and

- Direct Consolidation Loans that did not repay any PLUS loans made to parents.

SAVE includes eligibility for approximately five other loans, and does not currently offer eligibility for any types of PLUS loans. To find specifics on loan qualifications, or to see if you qualify, use the MyAid Page to learn more.

The FSA is currently accepting applications on their website. The average applicant requires 10 or less minutes to apply. The form does not mandate completion in a single session and can be saved to finish at a later date. The SAVE plan is one of four income-driven repayment plans currently offered by the Aid Administration.

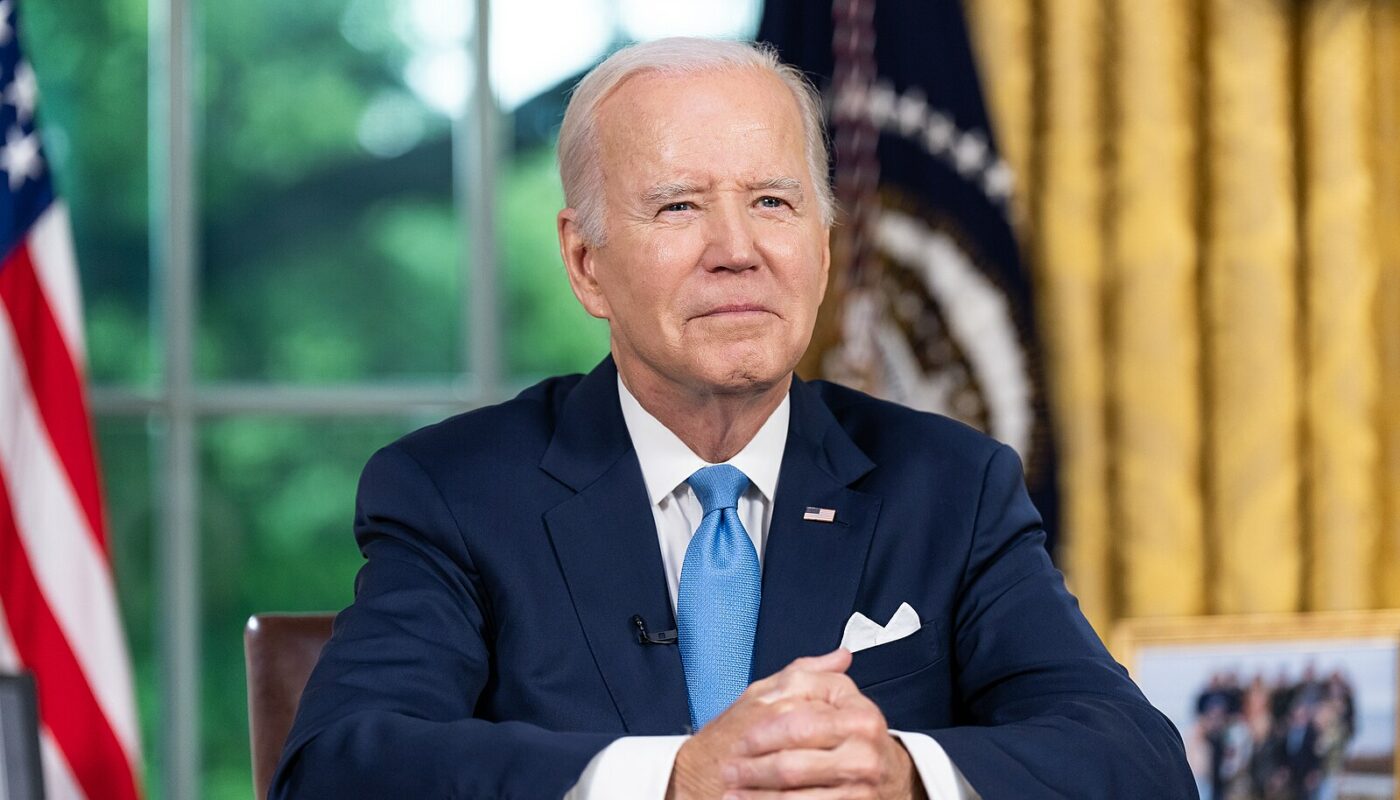

In conjunction with the SAVE plan, the White House also boasts the largest increase in Pell Grants in over a decade for families earning approximately $60,000 annually. In an August speech, President Biden claimed to have absolved $116 billion in debt cancellation for 3.4 million Americans. Additionally, he renewed promises to extend the program’s benefits, as well as the qualifications for borrowers to receive funds in the future.

While some borrowers will be impacted by the SAVE plan, many won’t. According to The New York Times, federal student loan payments, which had previously been suspended since 2020, will restart in October of this year.

Economists are estimating a crimp in the economy as the holiday season approaches, with a number of American consumers reporting that they plan to cut back spending this December. While estimates are not certain, it is suspected that the potential hit would be significant, but would not cause a recession.

Borrowers and consumers can expect further complications as Congress has yet to reach an agreement on the annual appropriations bills, with the potential for shutdown on the horizon.